The pandemic has been, and continues to be, very stressful for everyone, including veterinarians, their staff, and pet owners. While there are positive signs of recovery as more eligible people get vaccinated, we know the entire country, including our profession, is still feeling the impact of COVID-19, and that will probably continue for some time. We at the American Veterinary Medical Association want our members to know that the AVMA understands these challenges and we are here to support members, with resources to manage through this new environment—like our telehealth guide and wellbeing resources to help veterinarians and teams cope with the stress they’re facing.

We know that practices have been through immensely challenging times, and the last two years have felt like a roller coaster. We’ve seen swings in the economy and in demand. There has been a lot of speculation and conflicting data regarding pet ownership numbers, which translates to uncertainty when it comes to demand for veterinary services. Have pet populations really increased, and if so by how much? Who is acquiring new pets? Are these changes temporary, cyclical, or the new normal?

The AVMA has spent the last two years collecting, analyzing, and interpreting data to see how ownership and demand have changed since COVID-19. Our recent survey of pet owners was conducted in early 2021 and we received over 2,000 responses. Advanced weighting techniques were used to ensure data accurately represents pet ownership in the United States. We will have a newly updated pet ownership report available early next year.

In the meantime, we know that practices are seeing growth in visits and revenue but also experiencing challenging workforce issues at the same time. Utilizing strategies that address both issues is the key to success.

Let’s take a look at what we know about clients and their pets.

Adaptable strategies for maximum flexibility

When practices see increases in demand it’s important to implement the right strategies. Making sure your strategies can adapt as demand changes will give you the flexibility you need to maintain optimal efficiency, service, and profitability.

As we learned from Sheri Gilmartin, CVT and Esther Fraser of VetSuccess at the AVMA Veterinary Business and Economic Forum, it’s a tremendous time for growth, but there are also serious workforce challenges facing practices. For a deep dive into the veterinary workforce challenges, check out this article in JAVMA. Strategies that address both of these issues simultaneously will provide the best ROI for practices.

Growing populations, decreased efficiency

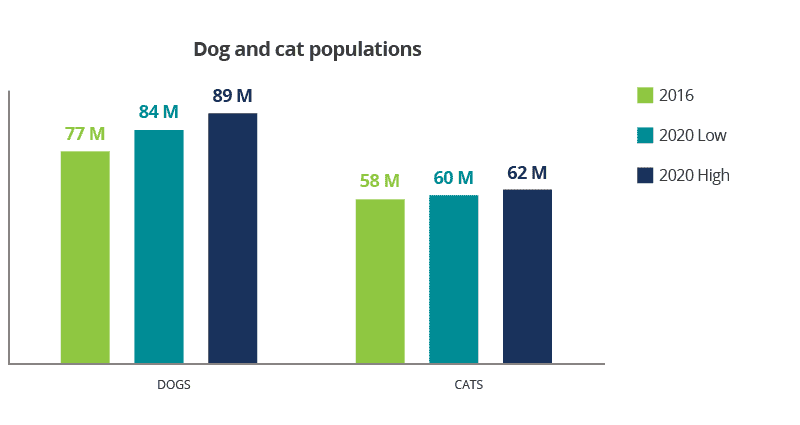

From the AVMA’s 2021 pet ownership survey, we found increases in both cat and dog populations as well as overall ownership. The dog population was between 83.7 million and 88.9 million in 2020 and the cat population was 60.2 to 61.9 million. Comparing these numbers to 2016, we find growth rates of 9% to 15.7% for dogs and 3.1% to 6.0% for cats.

Growth in pet populations and pet ownership translates to increases in demand for veterinary services, but it’s important to keep in mind why pet ownership is increasing.

We found people who work remotely, homeowners making over $100,000 in household income, and households who were financially better off or the same since COVID-19 were the most likely to acquire pets during the pandemic.

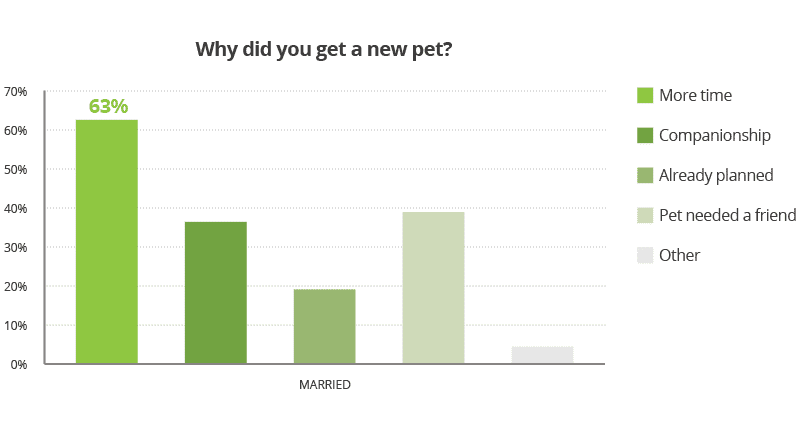

Additionally, remote workers were 8 times more likely to acquire a pet in 2020. We also found that married pet owners were most likely to cite having more time as the primary reason for acquiring a new pet.

Based on this data, we see that a sub-set of the general population acquired pets due to increased resources such as time and money. It remains to be seen if there will be further increases as many companies push for a return to the office which may decrease the amount of time people allocate towards pet ownership.

Data from the US Census Bureau also shows the pandemic did not impact all groups equally as the percentage of households making over $100,000 declined in 2020 going from 31.1% to 30.7%. The last recession in 2008 resulted in a decline in the percentage of households earning $100,000 or more and didn’t return to pre-recession levels (26.8%) until 2015 (27.6%).[1]

Homeownership has been in decline before the pandemic with each generation since baby boomers having lower rates of homeownership. Given changing rates of remote work, household income, and homeownership, and the influence each of these factors has on pet ownership, pet acquisition rates may differ in the future.

Strategies for success

Implementing strategies that focus on efficiency help address several issues at once.

First, they address increases in demand. Second, they address issues of increases in visit time as reported by VetSuccess and decreases in efficiency as reported from AVMA’s practice owner survey. Third, even if demand does not continue to increase at the same rate, improvements in efficiency such as staff utilization and leveraging technology have high ROI independent of increases in demand.

Throw in potential market uncertainty and it’s understandable why concerns arise. Within these concerns lie opportunities. Implementing strategies that focus on efficiency can help practices meet demand and address workforce issues, and with that in mind, the AVMA and VetSuccess developed a number of resources for practices.

Resources include:

- AVMA 2022 Pet Ownership Report (forthcoming)

- AVMA Business and Economics Forum

- AVMA State of the Profession Report

- AVMA Wellbeing resources

- Vetsource Veterinary Industry Tracker

REFERENCES:

1. https://www.ibisworld.com/us/bed/households-earning-more-than-100-000/35/

Definition of Households Earning More Than $100,000

This driver represents the percentage of US households with an annual income of more than $100,000. Data is inflation-adjusted and sourced from the US Census Bureau.