The veterinary industry is generally marked by consistent growth, increased pet owner spending, and evolving attitudes about pets as family members. But veterinary practice performance data from 2022 shows that the current veterinary workforce shortage, rising inflation rates, and a decline in disposable income all play a part in the delicate balance between pet owner and veterinary practice needs.

Due in part to the COVID-19 pandemic, veterinary practices saw high levels of financial prosperity and client demand throughout 2020 and 2021, but in 2022, we started to see those numbers level off. Was 2022’s modest performance simply an expected “return to normal” post-pandemic? Was it a conscious decision by practices facing workforce shortages to intentionally reduce burnout?

Most importantly for practice managers: What do all these metrics mean and how can you use them to make informed decisions for your veterinary practice? Let’s take a look at the 2022 data and identify trends to look for in 2023 and beyond.

Veterinary practice performance in 2022

The data experts at Vetsource (formerly VetSuccess) aggregate transactional data from thousands of veterinary practices across the United States, providing insight into what’s happening across the veterinary industry as a whole.

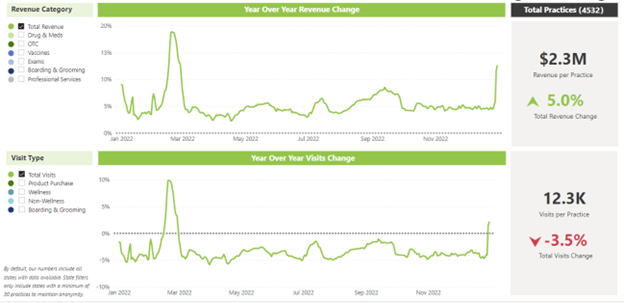

Looking at 2022 metrics, year-over-year compared to 2021 for traditional general practice hospitals, shows that total veterinary visits were down but revenue was up. While 2020 and 2021 may have been exceptional years due to the pandemic, creating challenges in comparing year-over-year numbers, comparing 2022 to a more typical year like 2019 shows that many of these metrics are still down.

Average revenue was up 5%, and the average revenue per patient was up 10.6%, with service revenue growth outpacing product revenue growth. Meanwhile average visits were down -3.5% with product-only visits taking the biggest hit at -7%. With so many choices available, pet owners are increasingly shopping around, and the growth reported by third party online pet retailers reflects that.

Lapsing patients (those without a transaction in the last 14 to 18 months) nearly doubled. When it comes to forward booking, the average rate for veterinary practices was only 15%-20% in 2022.

Veterinary trends to watch for in 2023

What does all this mean for veterinary practices in 2023? Data trends point to a need for practices to focus on increasing visits and meeting clients’ evolving expectations as a means for driving revenue growth, all while continuing to face staffing shortages and employee burnout. Will practices be able to shift out of survival mode and refocus on staff and client experience? Can practices bring lapsing patients and product purchases back? How can practices meaningfully improve efficiency?

Thanks to technological advances, practices have many options for boosting client engagement with retention marketing tactics such as reminder emails, texts, app notifications, and more. Traditionally, pharmacy accounts for 25% of a practice’s revenue, making it important for practices to compete for this business and capitalize on their patient medical data and other advantages that third party pharmacies do not have.

The growing workforce shortage, and the industry’s ability to solve for that, is an important trend to keep an eye on. Practices will need to get creative and take advantage of technology to address staffing issues in innovative ways. The ongoing conversations on how to maximize support staff is key to not only improving efficiency but also job satisfaction and the culture within a practice.

What does this all mean for your veterinary practice?

By keeping an eye on the metrics that matter, you can make data-driven decisions that fuel growth for your practice. Tools such as business performance reports, daily dashboards, and automated marketing programs can help you proactively plan instead of scrambling to react. Find out how Vetsource’s Data & Insights solution can make a difference for your business.