I knew I would enjoy the previous VetSuccess blog post titled “New veterinary revenue model indicates visits per year have greater impact than higher ACT” when I read the first sentence:

“One of the best things about math, specifically data analysis, is its ability to tease out truth from speculation.”

It gets to the heart of a topic that is near and dear to me: data; more importantly, how data can inform new ideas by challenging old ones.

While I invite readers to read the recent post for themselves the quick takeaway is this: an analysis of over 2,000 practice transactions shows that the greater contributor to overall veterinary revenue is not Average Client Transaction (ACT) — as is the prevailing wisdom in veterinary circles — but rather Invoices Per Patient (IPP) aka visits.

I took great delight in this insight as it is both old and new, at least to this economist.

Earns versus turns

It is old in the sense that it reminds me of the classic “earns versus turns” model of generating business. The basic idea is this: the more you turn customers around for repeat business, the greater the earnings.

In other words, you can generate more revenue in one of two ways:

- Get more out of a single visit from a given customer

- Get customers to come back more frequently (and maybe end up spending less per visit but more overall)

There is some data behind this notion.

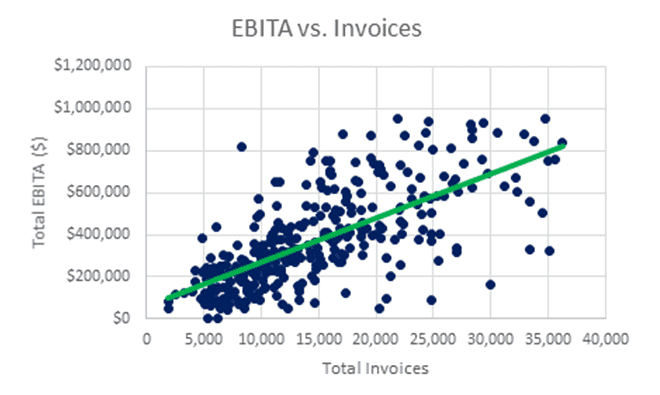

A couple of years ago, the AVMA Veterinary Economics Division collected anonymous data on about 400 practices across several metrics including revenue, EBITDA, invoices, and others. We looked at how some practice metrics were interrelated and one finding was particularly striking: practices with more invoices on average had consistently higher overall EBITA.

Consumption smoothing

There is another old concept this finding reminds me of too: consumption smoothing.

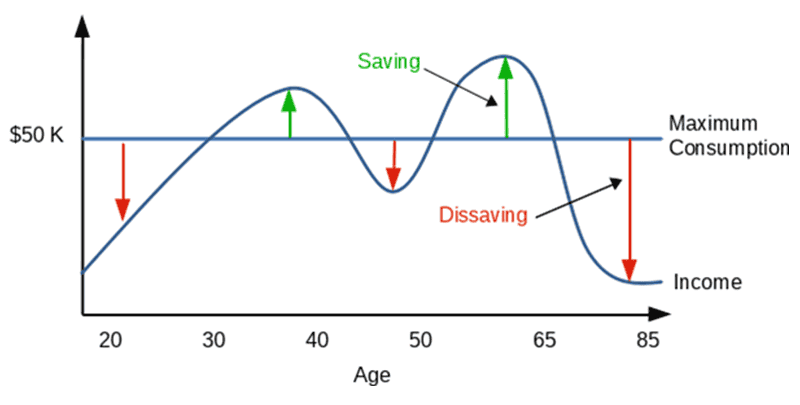

The idea here is that people have a rational desire to attain a stable path of consumption. It reflects the behavior of people to try and ensure a proper balance between spending and saving during the different phases of life. Consumption smoothing requires planning and sticking to a budget so that bills are paid when they come due. The figure shown here expresses this in a rather overly linear and simplistic way, but the point is conveyed.

The connection back to the finding by VetSuccess is that people are economically wired to want to avoid shocks to their budget and much prefer to smooth their expenditure over time.

The connection back to the finding by VetSuccess is that people are economically wired to want to avoid shocks to their budget and much prefer to smooth their expenditure over time.

Hence, the finding that Invoices per Patient is associated with better revenue outcomes than Average Client Transaction is consistent with the concept of consumption smoothing. Higher ACT represents the sort of shock to the budget consumers want to avoid whereas higher IPP is more consistent with spreading out veterinary expenditure over time.

“The lesson here is simple: Rather than try and generate the maximum revenue possible in a single visit, try instead to focus on getting the pet owner back into the practice more often.”

Amazon lesson

This is a lesson Amazon demonstrated ages ago when it began its now universally recognized Prime service.

This is a lesson Amazon demonstrated ages ago when it began its now universally recognized Prime service.

According to a Business Insider article published last year, Prime customers place an average of 24 orders per year and spend $1,400 whereas non-Primer customers place an average of 13 order per year and spend $600. By providing an incentive to place more orders with free shipping, Amazon has motivated its customers to also spend more overall.

Prior to Prime, it was not an uncommon approach by consumers to add items in order to reach that $35 minimum basket to get free shipping. While this may have resulted in a higher overall transaction, it was not the best motivator for more frequent purchasing.

Compensation consideration

The finding by VetSuccess that Invoices per Patient matters more than Average Client Transaction also has implications for the veterinary workforce and how veterinarians are compensated.

The finding by VetSuccess that Invoices per Patient matters more than Average Client Transaction also has implications for the veterinary workforce and how veterinarians are compensated.

More often than not, compensation of veterinary associates is based on production: salaries are based on how much business revenue they generate from clients. On the surface, this would seem to make sense: the more money you make for the practice, the more money you make for yourself.

That said, this compensation structure tends to create the incentive to generate more dollars in a single visit with a particular patient, that is, higher Average Client Transaction.

The finding from VetSuccess suggests an interesting alternative: an incentive structure that is based on frequency of visits to the practice by the client. This would result in more revenue to the practice rather than focusing on ACT alone and also create more earnings potential for the associate as well.

The truth about veterinary ACT versus visits

Going back to the earlier quote around “teasing truth from speculation,” this is always more interesting when the truth runs counter to what we all assume to be already true. That said, you don’t get to choose what the truth is and once you find it, you can never go back.

To end with another quote by author Kami Garcia: “We don’t get to choose what is true. We only get to choose what we do about it.”

Let’s put this finding to use and innovate our strategies for a more successful and economically sustainable veterinary profession!