Does your normal appointment workflow include phone calls, texts, emails, videoconferencing, and online payment? Instead of asking your clients to juggle multiple communication methods, you can use a customized hospital app that will drive your clients to a centralized hub. With Vet2Pet’s all-inclusive client engagement platform, your clients will be able to navigate every part of their appointment—from scheduling to payment—in one place. Our new Virtual Payment feature means you’ll no longer need to ask for credit card numbers, send a payment link, or collect cash. Here are five reasons you’ll love our latest feature.

#1: Contactless payment is safer

Whether you are continuing curbside appointments, or converting to a mixture of curbside and in-office visits, Vet2Pet’s Virtual Payment will help you continue to protect your clients and team members. Instead of exchanging germ-covered cash, or swiping credit cards, your front desk team can simply collect each client’s digital payment through the app.

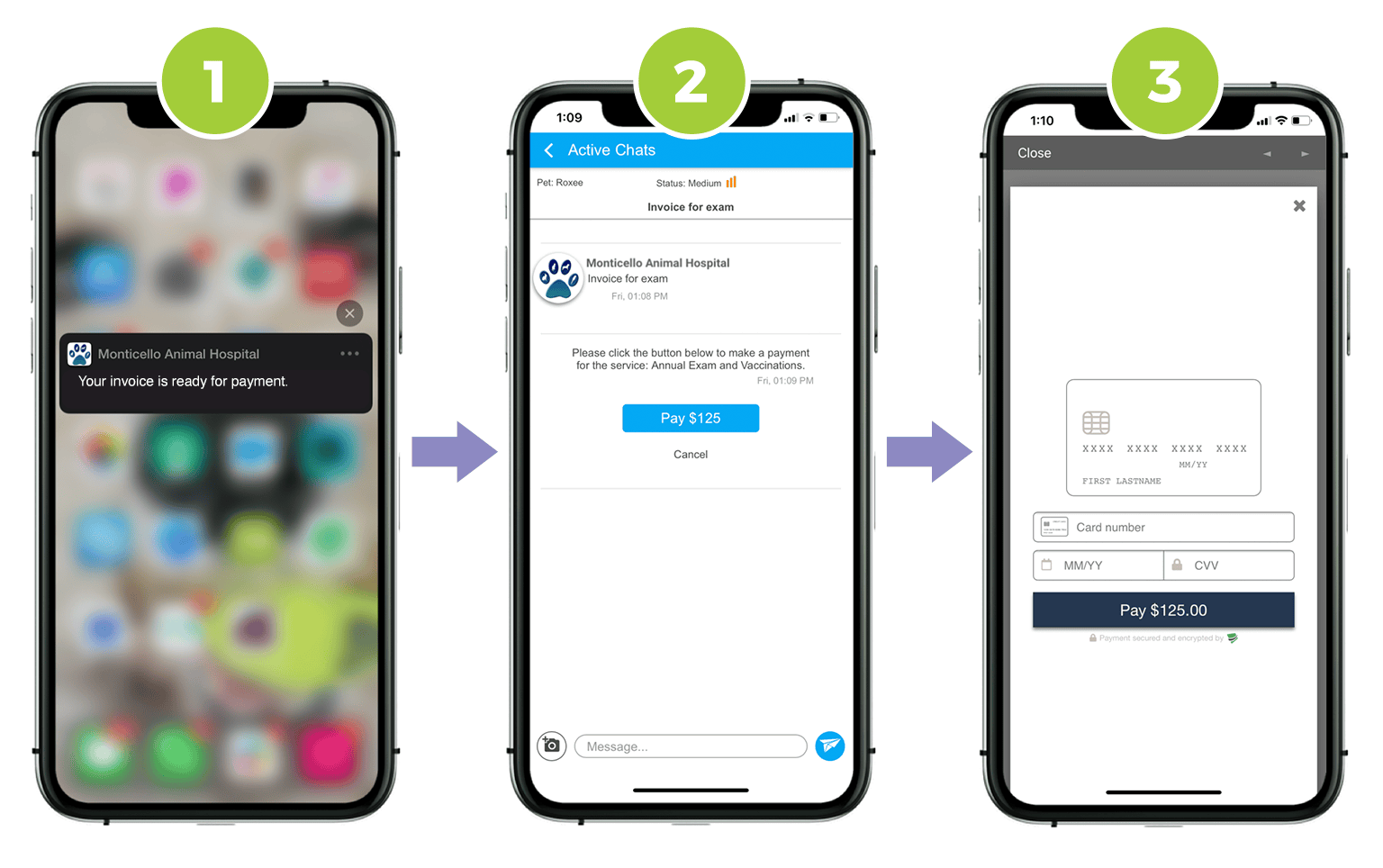

For curbside clients, you can send a message through our 2-Way Chat feature to let them know their invoice is ready, instead of sending a team member to their car with a credit card scanner, collecting card information over the phone, or texting a third-party payment link. In-hospital clients can pay their invoice in the exam room, and won’t have to stop at the front desk on their way out, which cuts down lobby congestion. And, if your drop-off appointment needs to be hospitalized, the pet owner can simply pay the deposit through your app.

#2: Collect telemedicine fees in the same app you use for appointments

If your technician is chatting with a client about their pet’s odd behavior that sounds suspiciously like reverse sneezing, they can quickly set up a telemedicine appointment, and collect payment through the app. The client can record a video of the pet’s behavior at their convenience, you can review it, and then use 2-Way Chat to discuss the case. The ability to quickly submit payment in the app will make the process simple and seamless for clients, who won’t have to relay a credit card number over the phone, or use another, less secure payment method.

#3: Your clients can pre-pay for medications

If Katniss’s owner remembers at midnight that she needs more Lasix, she can hop on the app and complete a refill request, instead of waiting until morning to call you, and risk forgetting. Instead of coming into your hospital to pay with cash, or swiping a credit card car-side, the client can pre-pay in the app. Since the medication is already paid for, your team can place the medication outside your door when she arrives, for contactless pickup. The entire process is more efficient for you, and prevents unnecessary hospital traffic.

#4: Clients will feel more secure submitting payments through your hospital’s branded app

I’m always a little uneasy when I receive a generic link to pay an invoice. After one particular instance, I’m extremely hesitant to fulfill text or email payment requests. A week after starting her job with Vet2Pet, one of my team members sent me a text from the Target parking lot that said, “I want to double check that you did need those 10 gift cards.” What? I hadn’t asked her to purchase anything. Someone claiming to be me had sent her a text message that said, “I’m in a meeting right now. I need you to do me a favor, and I can’t give you much information. I need you to go to Target and buy 10 gift cards for $100 each, and send me the information.” Fortunately, she was able to run back into the store, and stop the sale before processing was complete.

Unfortunately, situations like this happen often, and your clients are—or should be—leary of unbranded money requests. Vet2Pet’s Virtual Payment is a payment card industry (PCI)-compliant, secure way to collect payment. With your customized app, your clients will have peace of mind, knowing they are paying your hospital, not a scammer, and that Vet2Pet will never save their credit card information.

#5: Virtual Payment will save you money

We all know that credit card payments are inevitable, but exorbitant merchant fees linked to this convenience can eat away at your profit. Vet2Pet’s Virtual Payment doesn’t tack on extra merchant fees, in addition to the credit card charges. We want to support your business, not take away more revenue, so merchant fees with our Virtual Payment feature are only 3.5% plus 10 cents per transaction.

Are you ready to experience the benefits of Virtual Payment? Visit the Vet2Pet page for more info.