One of the most understated keys to profitability is good financial hygiene. In the same way that we have to take care of bodies personally, we must also take care of our businesses financially.

Financial fitness test

Q. As a practice owner, what’s the difference between cash versus accrual accounting and how does that impact the value of your business?

Q. What is a veterinary-specific Chart of Accounts and what impact can converting to this have on your practice?

Q. Do you have a strong level of confidence in your bookkeeping and overall financial health of your business?

If you’re scratching your head, fear not. We’ll dive into each of these to help increase your financial fitness.

Cash vs. accrual accounting

Let’s go back to that first question.

What is cash accounting?

Cash accounting is the process of recognizing your revenue and expenses in the timeframe in which the revenue is deposited in your account and when you write the check for your expenses. This is similar to the credits and debits in your bank account.

What is accrual accounting?

Accrual accounting is the process of matching your revenue and expenses to each other and to the timeframe in which the revenue was generated and the expense was incurred.

Consider this: Your manufacturer offers a special deal on a bulk purchase of heartworm preventive and you buy a 4-month supply. Accrual Accounting – The bill would be recorded in accounts payable and increase your inventory by the amount of the purchase. Each month, you record a journal entry to decrease inventory and expense the product as it is used. Cash Accounting – The expense would be recorded when you write the check or charge it on a credit card.

Consider this: Your manufacturer offers a special deal on a bulk purchase of heartworm preventive and you buy a 4-month supply. Accrual Accounting – The bill would be recorded in accounts payable and increase your inventory by the amount of the purchase. Each month, you record a journal entry to decrease inventory and expense the product as it is used. Cash Accounting – The expense would be recorded when you write the check or charge it on a credit card.

Even though it may seem like a simple accounting decision, there is considerable value in the accrual accounting method. This method versus cash accounting allows for greater control over your business and the ability to manage your financial decisions every month. This is also the only real way to measure profitability, by allocating the revenue and expenses to the time that you earned the income and paid the expense. Measuring and managing profitability leads to better medicine and increases the value of your practice while also making it easier to identify fraud.

Veterinary Chart of Accounts

In general, a Chart of Accounts is a standard for classifying and aggregating revenue, expense, and balance sheet accounts. Within veterinary practice management, the industry-accepted version is the AAHA/VMG Chart of Accounts.

In general, a Chart of Accounts is a standard for classifying and aggregating revenue, expense, and balance sheet accounts. Within veterinary practice management, the industry-accepted version is the AAHA/VMG Chart of Accounts.

You can use the Chart of Accounts to drive profitability not for profitability’s sake but in order to practice good medicine. Profitable practices are able to provide fair compensation for staff, thus retaining top talent, and are also able to purchase the best equipment.

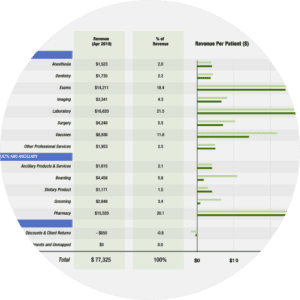

Converting to the AAHA/VMG Chart of Accounts provides numerous benefits. This includes creating a 1:1 relationship between your revenue and your direct cost, allowing for the identification of segment profitability, and benchmarking apples-to-apples across the veterinary industry. Switching can be a huge, tedious pain but VetSuccess does the work for you via the Practice Overview Report’s Revenue Statement.

Cultivate overall financial fitness for profitability

Be sure to dedicate appropriate time for preparing your numbers, analyzing your business, and implementing change.

Be sure to dedicate appropriate time for preparing your numbers, analyzing your business, and implementing change.

Ask yourself:

- What are my short-term and long-term objectives?

- How is my practice performing in various profit centers?

- How is my practice doing against the benchmark?

[bctt tweet=”Having good financial hygiene allows for peace of mind and comes with greater insight into your opportunities. “]

Often times, a hidden opportunity to increase profitability is just waiting to be discovered in your numbers. The job and even the joy of a practice manager then is to find and develop these opportunities.

Glenn Hanner is the tax and consulting partner in charge of the veterinary medicine practice at Whitley Penn, LLP. He has over 30 years experience helping veterinarians navigate the complex world of accounting. In addition to being a CPA, Glenn is a Certified Information Technology Professional and a Certified Valuation Analyst. He is committed to helping veterinarians create long term value for their practices and to achieve their professional goals.